General Information

The Time Off Accrual Data file is used to add, update or make adjustments on employee policy information.

It is not used to import adjustment information at this time.

Columns can be in any order and the column names have to be labeled exactly as below in order for the file to be imported.

Certain field can have data deleted using an asterisk (*) in the first position, those fields have been identified below.

File must be uploaded in .csv format.

Employees can have an unlimited amount of policies.

When a new policy is added to an employee and that policy is tied to a rollover policy, the rollover policy will automatically be added to the employee. No need to import rollover policies.

Fields that do not have a value in the import will be ignored and will not update the employee policy information.

Only have one column name of the same name per file. If multiple columns exist with the same name, the last column data will be used.

TOA Adjustments

Users can submit employee policy adjustments using the TOA Import file. The adjustment information can include four fields:

ADJ Type

ADJ Value

ADJ Date

ADJ Reason

Only the ADJ Type and ADJ Value fields are required in the file, along with Company ID, Employee ID, and Policy Name in order to create an adjustment (see rules below).

If one or more adjustments are imported for a policy that does not yet exist on an employee, the specified policy will be added to the employee with default information.

|

Column Name |

Max Length |

Field Format |

Description |

|

Company ID* |

8 |

alphanumeric |

Branch/Client Number |

|

Employee ID* |

10 |

alphanumeric |

The employee must already exist on the client. |

|

Policy Name* |

85 |

Alphanumeric and Special Characters |

Name of the Time Off Accrual Policy that is either being added or updated on the employee. Policies must already exist on the company. Policies can't be deleted using the asterisk. |

|

Balance |

12,6 |

Numeric -9999.999999 to 9999.999999 |

Initial policy balance when setting up the policy for the first time on an employee. Note: Also referred to as Credited Balance for applicable policies. Optional for all policies; if policy balances will be loaded it must be included when the policy is added. The Balance cannot be updated or deleted, via import, once it has been added to an employee. |

|

Uncredited Balance |

12,6 |

Numeric -9999.999999 to 9999.999999 |

Initial policy balance that has not yet been credited to the employee, for applicable policies only. Otherwise leave blank/exclude this column. The Uncredited Balance cannot be updated or deleted, via import, once it has been added to an employee. |

|

OV Accrual LOS |

3 |

Numeric If policy is in months 0 to 999 If policy is in years 0 to 99 if year |

Application field name: Length of Service Allows the user to override the calculated length of service for an employee with a static value. Optional use for multi-tiered policies otherwise leave blank/exclude this column. Data in this field can be added, updated and deleted via import. |

|

OV Accrual Rate |

13,6 |

Numeric 0 to 999999.999999 if hours or days or units |

Allows the user to override the amount of paid time off an employee is eligible to receive with the next accrual, based on their length of service. Optional field for accruing policies, otherwise leave blank/exclude this column. Data in this field can be added, updated and deleted via import. |

|

OV Anniversary Date |

10 |

MM/DD/YYYY |

Application Field Name: Length of Service Date An adjusted anniversary date is an override to the employee’s hire/rehire date when determining length of service. This date applies to all policies assigned to the employee. The date should only be sent on one policy record in the file. If more than one date is sent in the file for an employee the last date in the file for that employee will be used on all of the employee’s policies. Data in this field can be added, updated and deleted via import. |

|

The columns below are only required for Adjustment data. These columns can be appended to employee policy add/update rows, or a separate file can be submitted with just the standard required fields and ADJ columns. Adjustment Record Rules

|

|||

|

ADJ Type |

7 |

Accrued Taken |

Application Field Name: Required field for adjustments. This is the type of adjustment the user is trying to import. If this field is populated, the ADJ Value must be populated. Data can be added only. |

|

ADJ Value |

11,6 |

Numeric -9999.999999 to 9999.999999 |

Application field name: Adjust <ADJ Type> by Required field for adjustments. Allows the user to adjust the TOA balance. If the ADJ Value is populated, the ADJ Type must also be populated. Date can be added only. |

|

ADJ Date |

10 |

MM/DD/YYYY |

Application Name: Date of the Adjustment Optional for users that want to note a different date other than the date the import is run. Data can be added only. |

|

ADJ Reason |

250 |

Alphanumeric All special characters are allowed. Field must be quoted if text includes commas. |

Application Name: Reason Optional for users that want to enter an adjustment reason. Data can be added only. |

* Required field

Adjustment Record Examples

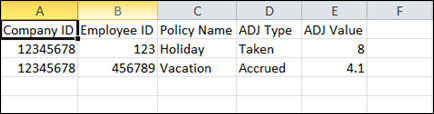

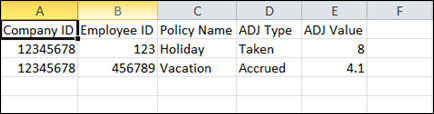

Simple Adjustment Import

Most common example, the policy already exists on the employee. The user would like to make adjustments to the balance.

In this case minimally five fields are required.

Since the ADJ Reason was not populated, in the file, a default reason 'Balance adjustment via import' will be applied to the adjustment record.

Since the ADJ Date was not populated, in the file, the date the import was run will be used in the adjustment record.

The ADJ Type of 'Taken' along with the ADJ Value of 8 will decrease the Holiday balance by 8.

The ADJ Type of 'Accrued' with the ADJ Value of 4.1 will add to the Vacation balance by 4.1.