![]()

The Direct Deposit option does not display if the Direct Deposit product is not active on the client. If you would like to subscribe to the Paychex Direct Deposit service, contact your local Paychex representative for setup information.

You can access the Direct Deposit view from the People icon.

|

|

The Direct Deposit option does not display if the Direct Deposit product is not active on the client. If you would like to subscribe to the Paychex Direct Deposit service, contact your local Paychex representative for setup information. |

Select Direct Deposit from the View menu.

To add a net pay direct deposit account, select ![]() in the Net Pay header. Editable fields display for entering the bank account information.

in the Net Pay header. Editable fields display for entering the bank account information.

Complete the applicable fields.

|

|

An asterisk (*) indicates a required field. |

Used for: Net Pay or Deduction will display based on the origin of the direct deposit allocation.

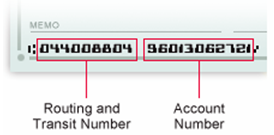

Routing & Transit Number*: The Routing & Transit Number is for the bank that the account is drawn on. This must be nine-digits long and completely filled with digits. The Routing & Transit Number is part of the MICR line that prints on every check.

This is the Account Number of the direct deposit bank account. The Account Number should be entered exactly as it is to appear on the check, with preceding spaces and spaces within the number if necessary. It is also part of the MICR line that prints on every check.

Account Number*: Enter the Account Number of the direct deposit account as it appears on the check.

Account Type: This is the type (checking or savings) of the direct deposit bank account; default is checking.

Calculation Method*: Select the appropriate method to use to calculate the direct deposit amount from the drop-down menu. Valid options:

Dollar Amount - Allows a fixed amount that is deposited into a particular account each pay period.

Percentage - Allows a percentage of net pay to be deposited to a particular account each pay period.

Remainder - Directs the system to deposit the remainder of net pay after all other partial deposits are made.

|

|

The value of remainder cannot be chosen for more than one bank account. |

Amount or %: Enter an amount or a percentage rate to calculate on. If the calculation method is percentage, the default value is 100%.

|

|

This field is required if the Calculation Method is Percentage or Dollar Amount. |

Click SAVE.

Select Direct Deposit from the View menu.

Select the Bank Account to be updated.

|

|

Only Net Pay direct deposits can be modified in the Direct Deposit view. To modify a deduction direct deposit, go to the Earnings & Deductions view. |

Update the applicable fields.

When the information is added or modified, click SAVE.

Paychex Direct Deposit/Chase Pay Card Plus uses several originating banks to initiate payments into the Automated Clearing House (ACH) network to transfer funds from an employer’s bank account to employees’ accounts for payroll purposes.

Direct Deposit Time Frame

Paychex requires two business days to process direct deposit transactions. This time frame allows Paychex to verify successful collection of funds from the employer before depositing funds into a worker’s bank account.

Next day direct deposit transactions are not guaranteed. If payroll checks are dated for a holiday or weekend, the funds will not be deposited into the workers’ accounts until the following business day.